innogy Innovation Hub Report 2017:

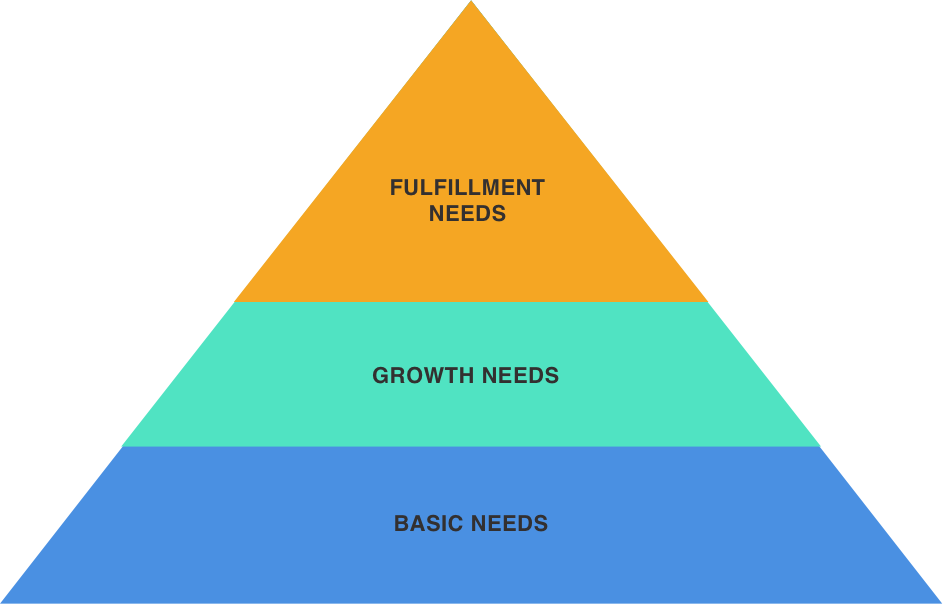

START UP INVESTMENT NEEDS

The true investment needs of the UK’s early-stage startups.

The UK Innovation Hub is focused on investing in early-stage UK startups. Together with Tech City UK, Seedcamp and 500 Startups, we have set out to identify what startups really need from investors. We did this by interviewing a wide range of UK tech founders and aspiring entrepreneurs.

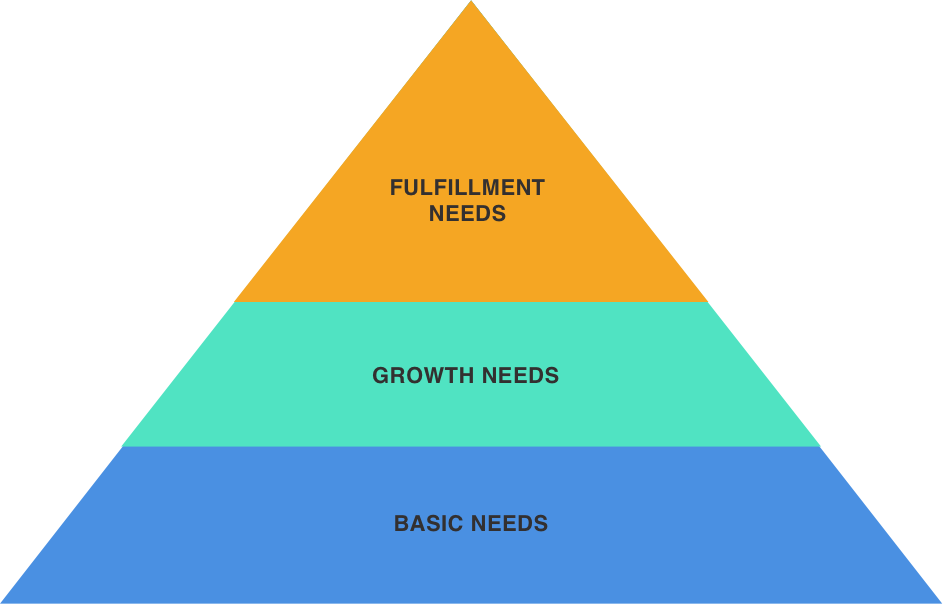

Basic needs – The most fundamental need is of course, access to finance. Beyond this, the priority hygiene factor is the ease of onboarding. Other basic needs – such as free office space and professional services or pitch training – are relatively inconsequential, as only a minority deem them to be important to their choice of investor.

Growth needs – Access to expertise, contacts and a wider network of investors is valued by a majority of founders. Just over half would also welcome the ability to follow on with further financing.

Fulfillment needs – Personal chemistry emerges as perhaps the critical factor – over nine in ten want an investor they like and trust. A similar proportion say that it is important the investor is in tune with their vision. Two thirds of startups also welcome the reassurance that their investor has a strong track record.

Q. What, if any, funding has your company accessed so far?

| Source of funding | % of startups |

| Family & friends | 61% |

| Pre-seed / startup programme | 54% |

| Seed | 48% |

| Series A (£2m+) | 9% |

Q. How long is your current cash runway?

| Cash runway | % of responses |

| Less than 6 months | 40% |

| 6 months -1 year | 33% |

| 1-2 years | 10% |

| 2-3 years | 3% |

Q. How significant are each of the following challenges for the growth of your business?

| Challenge | % responses |

| Access to capital | 90 |

| Marketing | 71 |

| Sales | 61 |

| Finding talent | 54 |

| Lack of expert advisors | 49 |

| Affordable offices | 43 |

| Product / UX | 41 |

| Access to data | 32 |

| Professional services | 23 |

For instance, the Tech Nation 2017 survey found that over just over half (51%) of business founders or CEOs cited lack of supply of skilled workers as a challenge, whilst just over two fifths (42%) mentioned access to finance.

In this survey, however, access to capital emerges as the number one growth challenge for entrepreneurs and aspiring entrepreneurs. Nine in ten say this is a challenge, some way ahead of marketing, sales and access to talent.

This may reflect the fact that many participants in the research are running early stage businesses where they are the business, performing all the important tasks with the help of a small team. Cash flow and sales are pivotal, while the challenges of growing a larger team are some way off.

Q. What type of growth challenges might you encounter?

|

Disruptive Digital Energy

|

Smart & | Urban | Machine | Big | |

| Connected | Solutions | Economy | Data | ||

| Access to capital | 83% | 76% | 79% | 79% | 77% |

| Lack of expert advisors | 67% | 41% | 32% | 43% | 34% |

| Access to data | 50% | 28% | 16% | 50% | 23% |

| Sales | 50% | 41% | 32% | 50% | 46% |

| Marketing | 50% | 48% | 37% | 57% | 54% |

| Affordable office space | 33% | 43% | 42% | 43% | 34% |

| Finding talent | 17% | 37% | 32% | 57% | 37% |

| Professional services | 17% | 15% | 21% | 0% | 20% |

| Product / UX | 0% | 26% | 37% | 29% | 26% |

Q. What roles have you found most difficult to hire?

| Role | % responses |

| Web developer | 47% |

| UI/UX Designer | 29% |

| Product | 24% |

| App developer | 24% |

| Digital marketing / sales | 22% |

| Data scientists | 21% |

| Finance | 14% |

| Legal | 7% |

| Customer support | 6% |

| Web analytics | 3% |

| Content manager | 2% |

Q. Have you used any of the following to find out about investors or to inform your investment strategy?

| Source | % of responses |

| Word of mouth | 63% |

| AngelList | 57% |

| TechCrunch | 51% |

| Crunchbase | 50% |

| Investor websites | 44% |

| Investor blogs | 36% |

| Tech City Newsletter | 24% |

| Mashable | 14% |

| Investment databases | 14% |

| CB Insights | 14% |

| Venturebeat | 13% |

| The Verge | 5% |

Q. Which of the following topics are you most interested in reading about?

| Topic | % of responses |

| Other startups | 68% |

| New funds | 65% |

| Investor advice | 57% |

| Competitive landscape | 54% |

| Market trends | 53% |

| Entrepreneur tips | 51% |

| Scaling | 50% |

| Marketing / PR | 45% |

| Investment trends | 34% |

| Financial advice | 29% |

| Recruiting talent | 28% |

| Programming | 28% |

| Pitching | 26% |

| Legal info | 20% |

Q. What type of investment channels are you currently considering or might you consider in the future?

| Investment type | % who would consider this funding |

| Angels | 66% |

| VC’s | 54% |

| Strategic investor | 43% |

| Accelerators | 39% |

| Crowdfunding | 31% |

| Family / friends | 22% |

| Competitions | 20% |

| Bank loan | 14% |

| Not raising | 7% |

| P2P loan | 4% |

Q: What type of investment channels are you currently considering or might you consider in the future?

| Investment type | Disruptive Digital Energy | Smart & Connected |

Urban Solutions |

Machine Economy |

Big Data |

|

| Crowdfunding | 0% | 41% | 32% | 43% | 29% | |

| Angels | 50% | 72% | 79% | 71% | 66% | |

| Competitions | 50% | 28% | 32% | 29% | 14% | |

| VC’s | 50% | 50% | 63% | 57% | 63% | |

| Accelerators | 50% | 54% | 53% | 57% | 34% | |

| Bank loan | 0% | 13% | 11% | 7% | 9% | |

| Family and friends | 17% | 20% | 21% | 29% | 23% | |

| P2P loan | 17% | 7% | 0% | 0% | 6% | |

| Strategic Investor | 33% | 46% | 53% | 43% | 51% |

Q. What will the money you raise primarily be used for?

| Activity | % responses |

| Marketing | 27% |

| Product / Design / UX | 26 % |

| Talent | 19% |

| Engineering | 17% |

| Accessing new markets | 7% |

| Other | 4% |

Maslow’s (1943, 1954) hierarchy of needs is a motivational theory comprising a five tier model of human needs. Its central tenet is that people are motivated to achieve certain needs and that some needs take precedence over others.

Our most basic need is for physical survival, and this will be the first thing that motivates our behaviour. Once that level is fulfilled the next level up is what motivates us, and so on.

This is a useful framework for understanding what entrepreneurs need from their investors.

Q. How important, if at all, are each of the following to you when choosing an investor?

| Need | % response |

| Personal chemistry | 93 |

| Product understanding | 92 |

| Their track record | 68 |

| Their expertise/contacts | 62 |

| Ease of application | 58 |

| Access to further financing | 51 |

| Low maintenance relationship | 43 |

| Personal recommendation | 40 |

Q How important, if at all, are each of the following to you when choosing an investor?

| Qualities of an investor | % responses |

| Personal chemistry | 93 |

| Product understanding | 92 |

| Their track record | 68 |

| Expertise and contacts | 62 |

| Ease of application | 58 |

| Follow on financing | 51 |

| Low maintenance relationship | 43 |

| Personal recommendation | 40 |

Q. How important are each of the following when choosing an investor?

| Need | % response |

| Investor network | 70% |

| Provide advice / support | 61% |

| Follow on financing | 51% |

| Hiring support | 27% |

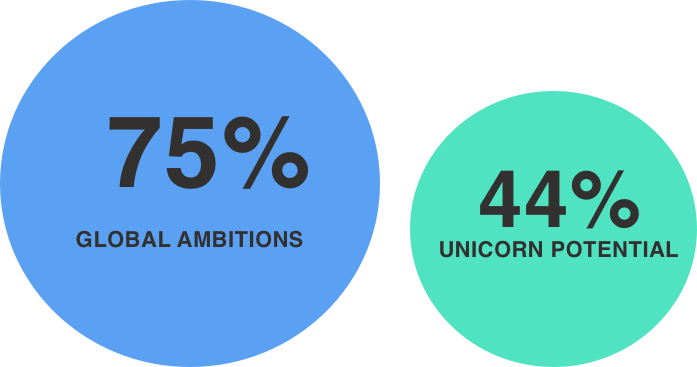

This report details the findings of a quantitative survey among UK Digital Tech businesses. It is based on the responses of 131 tech founders and 33 aspiring tech founders, a total of 164 completed surveys.

The research aimed to profile the founder/ aspirational founder population and it focused on understanding their business challenges as well as their needs in relation to an investment partner. Interviewing was conducted in February and March 2017, using an online survey.

Over two fifths of startups (44%) who responded to the survey classify themselves as Smart and Connected, whilst a third (34%) fall under Big Data. Some 6% classify themselves as Disruptive Digital Energy, the smallest of our segments.

| Smart and connected | 45% |

| Big data | 34% |

| Urban solutions | 18% |

| Machine economy | 14% |

| Disruptive digital energy | 6% |